Heart Paydays: Where Financial Support Meets Tech Innovation

In the ever-evolving landscape of financial services, Heart Paydays stands out as a trusted name that caters to the unique needs of individuals facing financial challenges. With a commitment to providing specialized financial solutions, Heart Paydays has become a beacon of support for those seeking financial assistance, regardless of their credit history. This article takes you through the journey of Heart Paydays, unveiling the story behind its inception and shedding light on its user-centric approach to financial services.

The Birth of Heart Paydays

Heart Paydays emerged in response to a growing demand for accessible and accommodating financial services. Its founders recognized the need for a service that could provide a financial lifeline when unexpected expenses strike. This recognition led to the birth of Heart Paydays, a brand committed to helping individuals navigate their financial emergencies.

Heart Paydays identified a niche market consisting of individuals who may have struggled to secure loans through traditional channels due to low or no credit scores. Their target audience includes those who require financial assistance to address urgent and unforeseen expenses.

At the core of Heart Paydays' vision lies the belief that everyone deserves access to reliable financial solutions, regardless of their credit history. The brand's values include transparency, integrity, and a genuine desire to help those in need.

Specialized Financial Services

Heart Paydays specializes in providing a wide range of financial solutions, including:

- Installment Loans: These loans cater to individuals who need to address immediate expenses like medical bills, wedding costs, or college tuitions. With flexible terms and personalized options, Heart Paydays ensures that borrowers can find a solution that suits their unique financial circumstances.

- Bad Credit Loans: Heart Paydays is dedicated to helping those with low or no credit scores secure loans. Their network of lenders is tailored to accommodate individuals facing credit challenges, providing them with a lifeline when traditional financial institutions may have turned them away.

- Guaranteed Approval Loans: Heart Paydays offers guaranteed installment loans for those seeking financial assistance. These loans come with the assurance that eligible borrowers can access the funds they need quickly.

The specialized services provided by Heart Paydays address the urgent and often unexpected financial needs of their customers. Whether it's an unforeseen medical expense, car breakdown, or an upcoming wedding, Heart Paydays has tailored solutions that can provide financial relief when it matters most.

Tech-Driven Financial Solutions

The foundation of Heart Paydays' success is its reliance on cutting-edge technology. By harnessing technological innovations, the brand streamlines the loan application and approval process, ensuring that borrowers can access funds quickly and conveniently.

User-Centric Design

User experience is paramount to Heart Paydays. The brand is designed with the user in mind, ensuring that the application process is straightforward, and borrowers can easily navigate their financial journey.

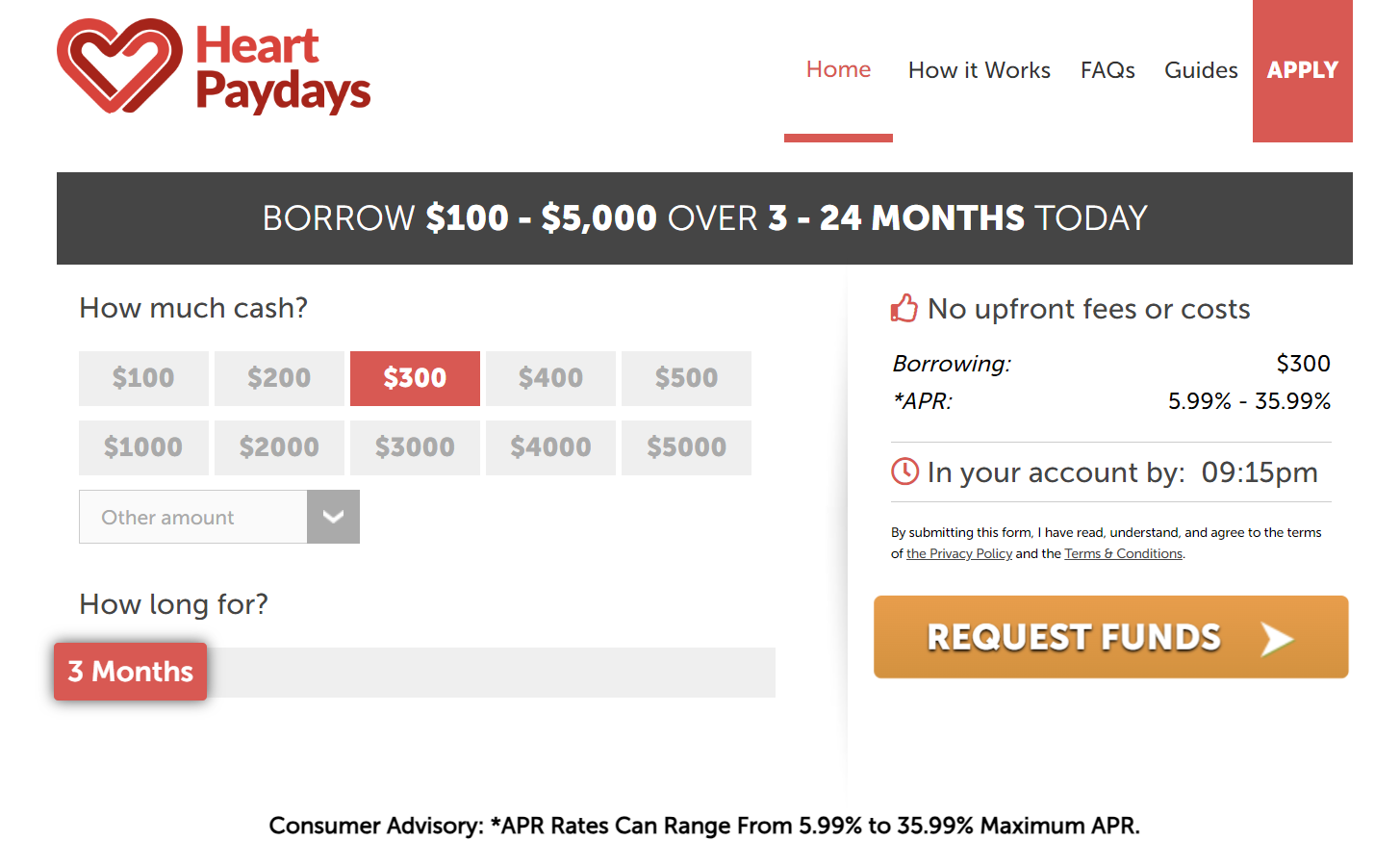

Heart Paydays offers an intuitive and user-friendly interface that allows borrowers to select loan amounts and repayment periods that align with their financial capabilities. This customization empowers borrowers to take control of their financial future.

Heart Paydays actively listens to its users. Feedback is a driving force behind the brand's continuous improvements, ensuring that the services offered evolve in line with the needs and preferences of its customers.

Regulatory Compliance and Data Security

Heart Paydays prioritizes regulatory compliance. The brand operates within the framework of financial regulations, safeguarding the interests of both borrowers and lenders.

Data security is a top priority. Heart Paydays employs robust data encryption and privacy measures to protect the sensitive information of its customers, building trust through a secure environment.

Heart Paydays has established itself as a reliable and innovative financial service provider, offering specialized solutions for individuals facing financial challenges. Through its user-centric approach, commitment to regulatory compliance, and continuous improvement, Heart Paydays has made a positive impact on the lives of countless individuals, providing a financial safety net when it's needed most.

FAQ

Can I get an installment loan with bad credit through Heart Paydays?

Yes, Heart Paydays collaborates with lenders that specialize in serving individuals with low or no credit scores, increasing your chances of securing a loan.

What are the eligibility requirements for receiving an installment loan through Heart Paydays?

Basic eligibility criteria typically include being over 18 years old, having a United States bank account, and a valid email address and mobile phone number.

What's the difference between payday loans and installment loans through Heart Paydays?

Payday loans and installment loans both fall under the category of installment loans. However, payday loans are typically short-term and have higher interest rates, while other installment loans have longer terms and may require credit checks.

What can I use an installment loan for through Heart Paydays?

You can use an installment loan for various financial needs, including unexpected expenses like medical bills, car repairs, or wedding costs.